Rental yields play a crucial role for property investors, driving the cashflow equation and can make all the difference in the investor’s ability to hold onto the asset over the long run and benefit from capital growth. With returns varying across both capital cities and regional hotspots, it pays to know where locations are the strongest for rental yield.

But first, let’s look at some factors that drive rental growth:

- Location and Tenant Profiles: Areas near business districts, public transport, schools, universities, and hospitals tend to attract a steady flow of tenants. This steady demand is a tailwind on rental growth and lowers of the risk of vacancy.

- Low Vacancy Rates: When properties face low vacancy levels and enjoy a stable tenant base, rental prices tend to climb which improves the rental yield of the asset over time (for the owners of those rental properties).

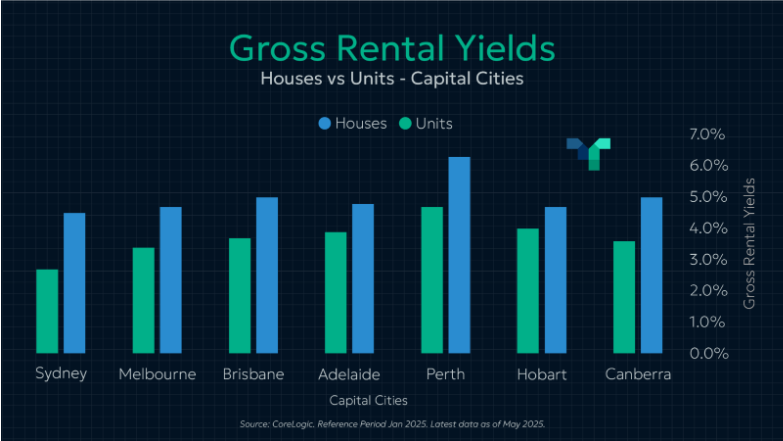

- Property Type: Recent CoreLogic data shows that, in capital cities, apartments generally yield higher returns than houses, although multi-tenant houses (such a dual key and co-living properties) will often outperform units in rental yields.

How Do Capital Cities Compare?

Looking at the latest data as of May 2025, Perth leads the way in rental yields for both houses and units, in fact, Perth median rental yield for houses at 4.5% is similar to the unit rental yields in cities like Sydney (4.6%), Melbourne (4.7%), and Hobart (4.7%).

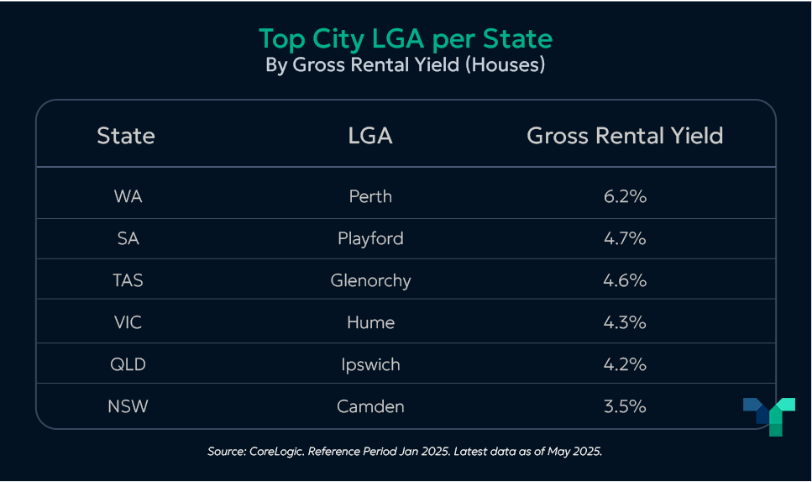

Drilling down to the city council level for house rental yields in each capital city, Perth LGA leads with a yield of 6.2%, followed by South Australia’s Playford at 4.7%, and Tasmania’s Glenorchy at 4.6%. In contrast, NSW’s Camden registers a more modest 3.5%.

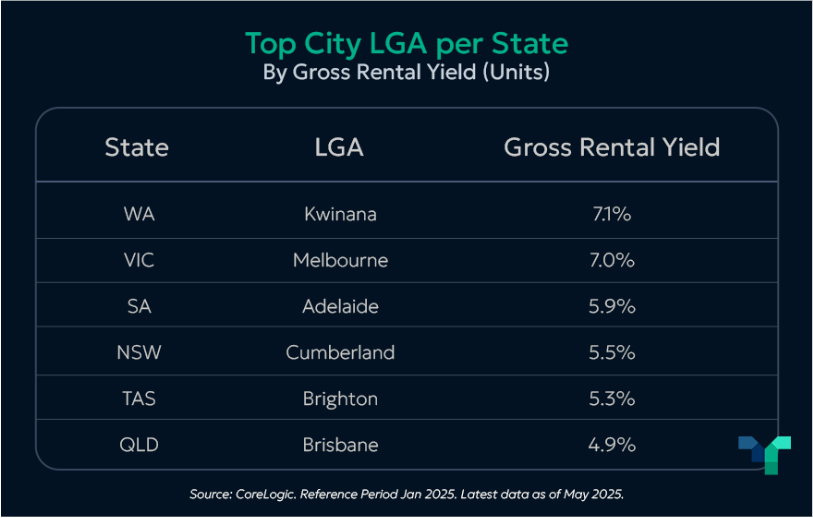

Looking at the top LGAs for unit rental yields, WA’s Kwinana LGA tops the list with a yield of 7.1%, followed by a leading Melbourne LGA at 7.0%, and an Adelaide LGA at 5.9%.

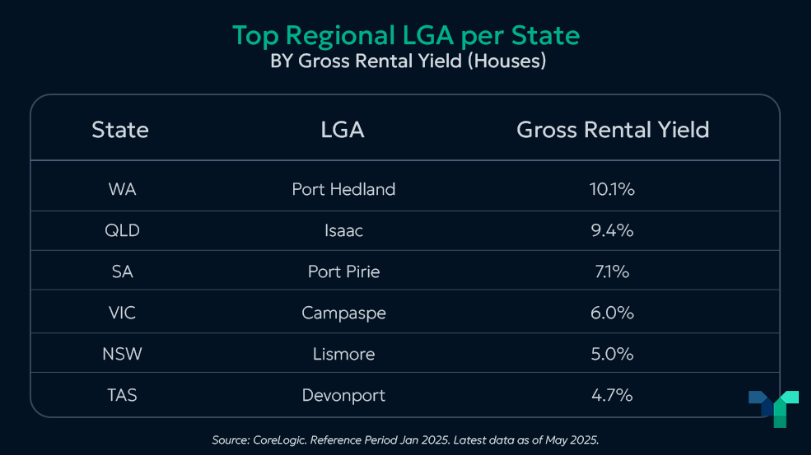

Regional markets are outperforming the capital city yields for houses (which is no surprise). For houses, Port Hedland (WA) leads with 10.1%, followed by Isaac (QLD) at 9.4%, while Port Pirie (SA) comes in third at 7.1%.

Investment Considerations

Whilst every investor has a different financial situation, managing the cashflow of the investment property (or properties in a portfolio) is a vital requirement for the investors ability to hold onto the asset over the long term and reap the rewards of a leveraged compounding investment. As seen in recent years, interest rates can rise sharply in response to macro-level events, and any cashflow negative properties may become unsustainable to hang onto.

Summary:

- Location, tenant demand, and property type are critical factors influencing rental yields.

- Units tend to deliver higher yields than houses in the same city

- WA LGAs takes top place in rental yields for both houses and units

- Regional markets outperform capital cities for house yields, with Port Hedland LGA in WA leading at 10.1%.