The 2025-26 Federal Budget has introduced a substantial $33 billion housing initiative, marking Australia’s largest government intervention aimed at addressing the housing crisis.

Despite this significant commitment, key indicators suggest that housing challenges may not only persist, but could potentially worsen in the coming years due to fundamental supply constraints.

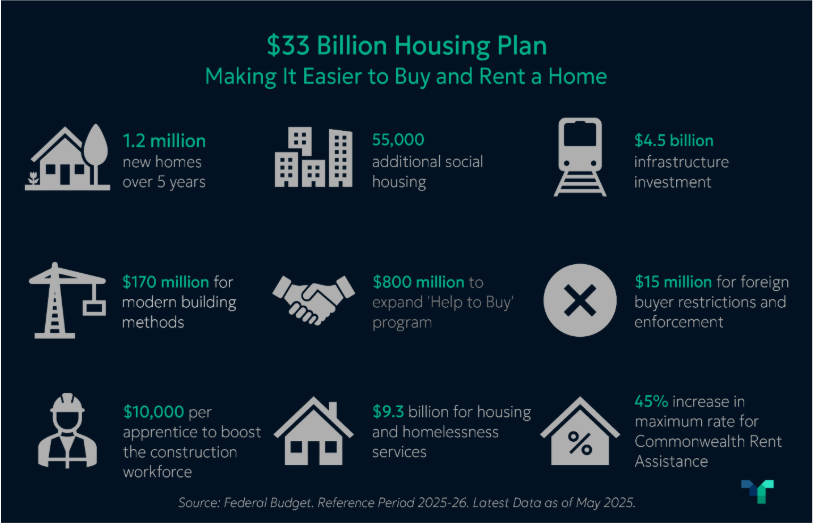

Breakdown of the $33 Billion Housing Initiative

This initiative is called the National Housing Accord, which aims to deliver 1.2 million new homes over a five-year period (2024-2029). Key components include:

Support for Homebuyers and Renters:

- For buyers: an expanded Help to Buy program covering up to 40% of purchase prices for eligible buyers

- For renters: a 45% increase in the maximum rate for Commonwealth Rent Assistance, benefiting approximately one million rental households

Ban on Foreign Buyers

Two-year prohibition on foreign purchases of existing homes, effective April 1, 2025

- $5.7 million allocated to the ATO for compliance enforcement

- $8.9 million dedicated to preventing land banking practices by foreign investors

Modern Construction Methods

- $120 million to streamline regulatory processes for modular and prefabricated construction

- $50 million investment in enhancing Australia’s contemporary building capabilities

Construction Workforce Development

- Financial incentives of up to $10,000 for eligible apprentices

- Priority Hiring Incentive of up to $5,000 for employers taking on apprentices

Why All This May Not Work

The National Housing Accord’s first quarter resulted in just 45,000 completed homes, significantly below the 60,000 quarterly target required to achieve the 1.2 million goal. The initiative is not off to a great start.

While the $33 billion investment appears substantial, it fails to adequately address the fundamental and structural issues with creating new housing supply in Australia.

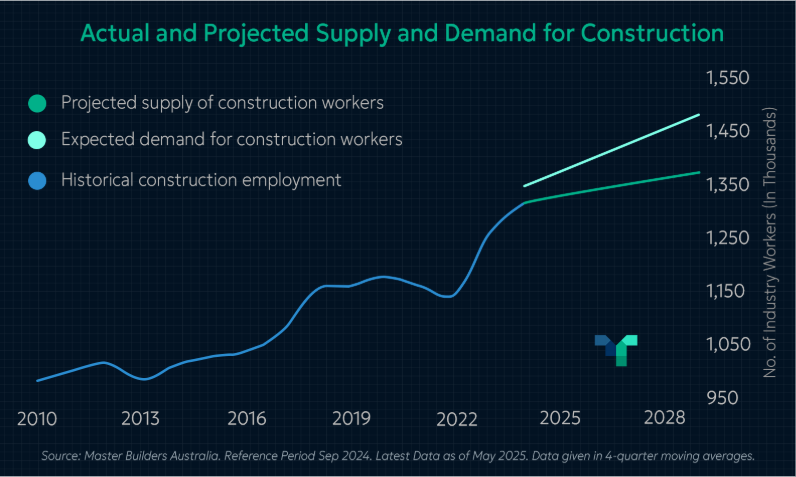

Construction Industry Constraints

The building sector faces significant workforce challenges. According to Master Builders Australia, the industry needs to expand to approximately 1.5 million workers by 2029 in order to meet construction demands. Currently, the industry is employing about 1.37 million workers, so the sector requires an additional 130,000 workers—a 10% increase—over the next five years. This does not seem likely to eventuate.

This challenge is compounded by high industry turnover, with over 100,000 workers exiting annually due to retirement and career changes. This translates to replacing more than 500,000 workers over five years, plus the additional 130,000 new positions. While apprenticeship incentives represent a step in the right direction, the required growth in workforce is significant.

Fundamental Issues Not Address by the Budget

The budget overlooks critical barriers to housing supply:

- Zoning restrictions: Substantial residential land remains constrained by stringent zoning laws, severely limiting development potential of the higher density needed to meet the housing targets.

- Council approval delays: Federal Treasury analysis shows housing approval wait times have expanded to four months in VIC and NSW, increasing costs – time is money in property development – making some projects unviable.

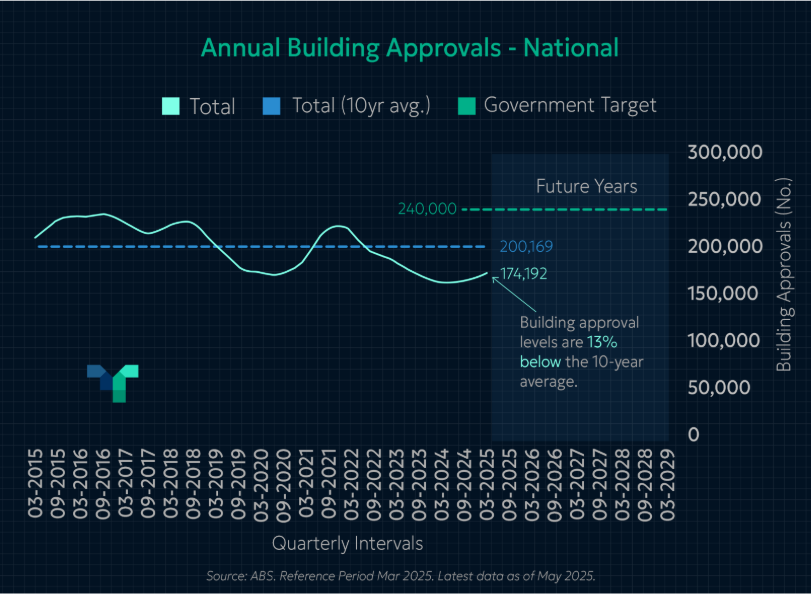

- Approval shortfalls: ABS data reveals annual housing approvals are 13% below the 10-year average and 27% under the government’s target, indicating the building industry will struggle to meet the 1.2 million housing goal.

Implications for Property Investors

These persistent supply constraints suggest housing prices will likely continue rising:

- Limited supply: The combination of restrictive zoning, construction labor shortages, and approval delays means Australia cannot build enough homes to meet demand.

- Higher-than-average demand: Immigration and population growth continue to fuel housing requirements.

- Market fundamentals: The ongoing gap between supply and demand will likely drive further increases in house prices and rents.

Summary:

- The Federal Government has committed $33 billion to address the housing crisis, but is already missing targets with only 45,000 homes built versus the required 60,000 in the first quarter

- Labor shortages in construction present a significant barrier, with the industry needing to grow by 130,000 workers while simultaneously replacing 500,000 others

- The budget fails to address fundamental constraints including restrictive zoning and council approval delays

- For investors, these ongoing supply challenges combined with strong demand suggest property values will remain elevated for the foreseeable future.