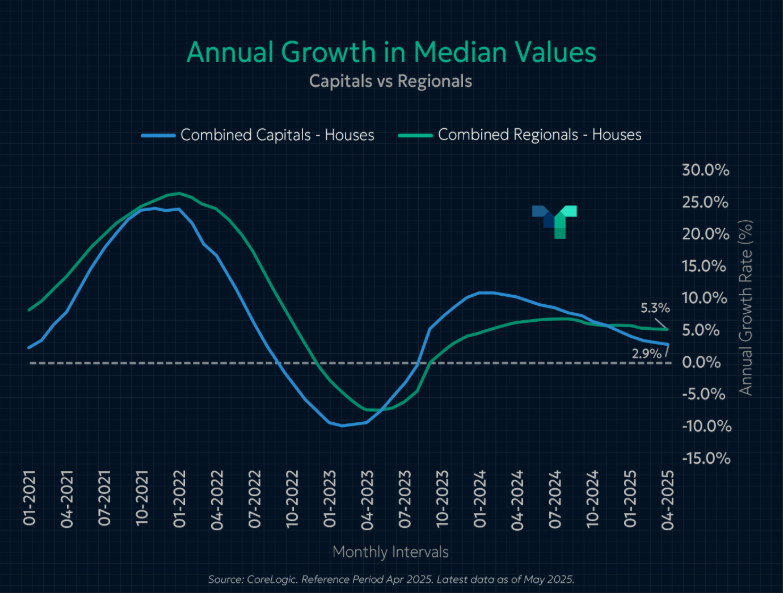

Since the start of 2025, the real estate markets in regional areas have outpaced the growth in capital city markets, and the gap is widening with each month. Data from CoreLogic that tracks the aggregate median price change for combined regional markets and capital city markets shows that aggregate regional markets are growing at a pace of 5.3% pa while capital cities are growing at 2.9% pa.

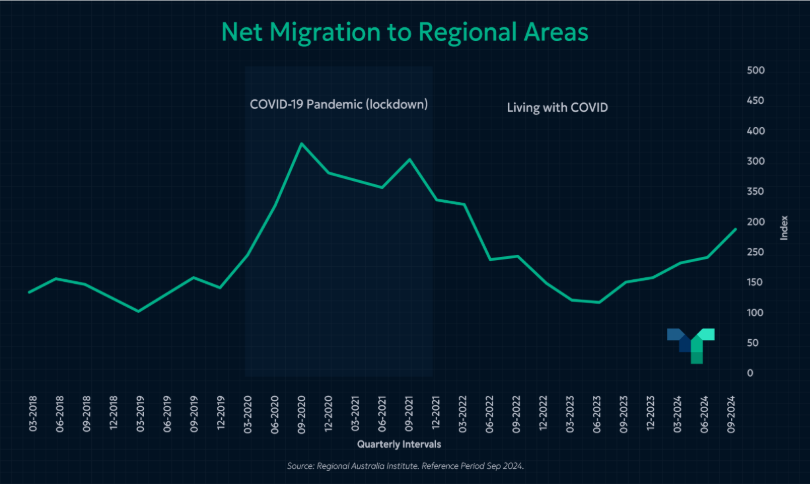

Regional migration is at the heart of this shift. Figures from the Regional Movers Index show a 23.4% rise in net migration over September 2024 quarter, the highest rate since March 2022 quarter, and follows five consecutive quarters of increases.

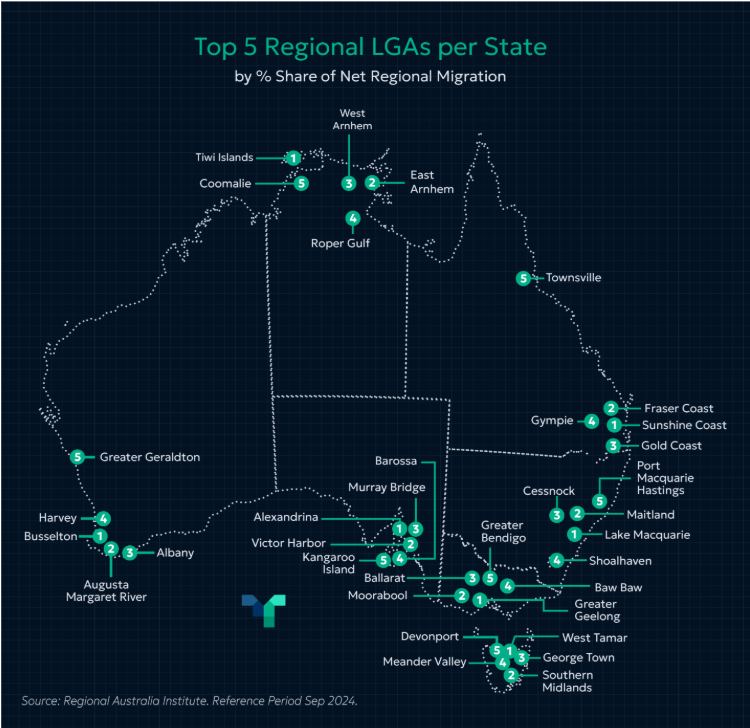

Looking closer at these population shifts, coastal local government areas remain top picks. Places like the Sunshine Coast, Greater Geelong, and Lake Macquarie are drawing the most internal moves, while inland spots such as Maitland and Moorabool are also experiencing high migration inflows. These movements are mapped out below showing the top 5 LGAs by state that are receiving the highest levels of migration.

From a property investment perspective, rising net migration signals increased demand for housing, and will put upward pressure on house prices if supply cannot respond.

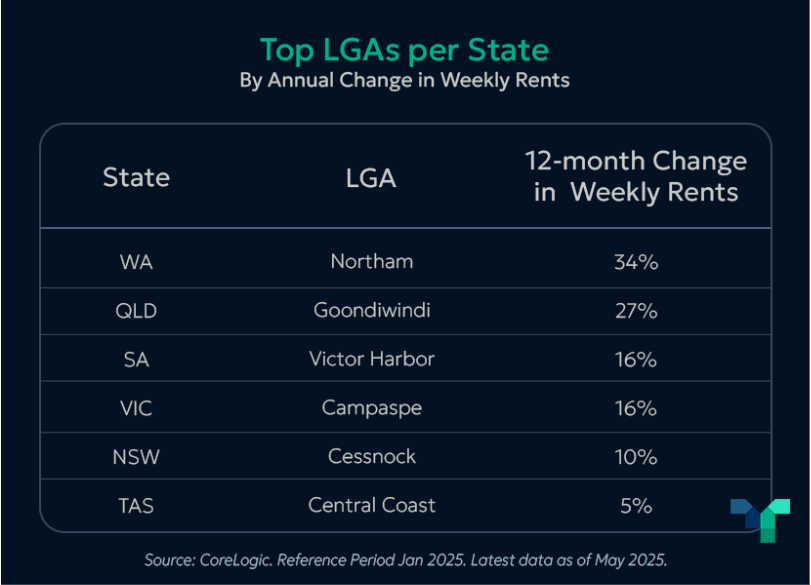

The table below shows the top LGA in each state by median price annual growth rate. At this stage in the market cycle, regional LGAs in WA, QLD, NSW and SA have recorded the highest growth rates, while regional LGAs in VIC and TAS are showing trends of a starting growth phase.

Looking at the rental market (a subset of the housing market) tells a slightly different story. Growth in rents has been the strongest over the last 12 months in the regional LGAs of WA and QLD whilst rent growth in regional SA, VIC, and NSW are lagging slightly, but are trending higher. Regional TAS LGA recorded a modest growth.

Infrastructure investments in regional areas are also playing a major role in attracting new residents. Significant projects, like a $605.7 million package for road upgrades in Northern Australia, along with other major infrastructure investments like the $177 million for the Warrego Highway, $137.5 million for the Nelson Bay Road project, $101.9 million for regional airport upgrades, $80 million for the Lyell Highway, and $40 million for wider connectivity—are all helping to boost the appeal of regional areas through job creation and improved amenity.

Summary:

- Net regional migration jumped 23.4% QoQ, with both coastal and inland areas showing high migration inflow.

- Regional property values are outpacing major cities, with house values up by 5.3% pa in the combined regions versus 2.9% pa for the combined cities

- Regions in WA, QLD, NSW and SA are showing growth at double digits and are further progressed in the market cycle compared to Regional VIC and TAS

- Rental demand in the regions is strong, with many areas recording double-digit growth in rents

- Major infrastructure projects will attract new residents through job creation, adding to the housing demand in the regions