Australia’s property landscape is experiencing a significant transformation driven by changing demographics and sustained population growth. With projections indicating the national population will reach 31 million by 2035, understanding population movements has become crucial for property investment strategy. Recent demographic shifts are creating new patterns of housing demand with direct implications for property values and investment outlook.

Current Growth Patterns

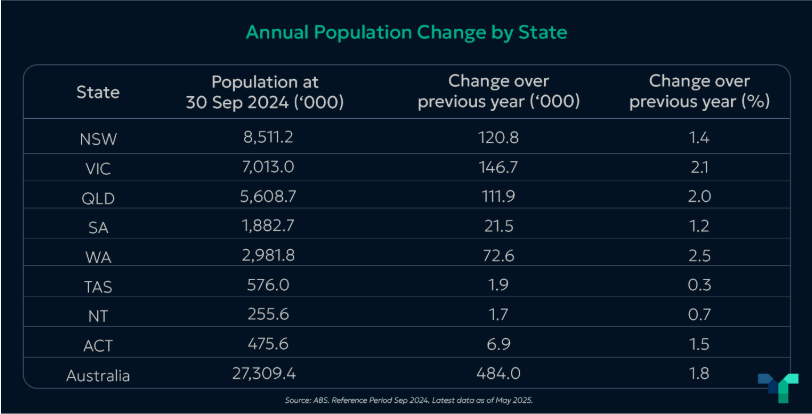

Population growth is a fundamental driver of housing demand, and when this demand exceeds available supply, both property prices and rental rates experience upward pressure. According to the latest ABS data as of May 2025, Western Australia is leading with an annual population growth rate of 2.5%, followed by Victoria at 2.1% and Queensland at 2.0%.

New South Wales remains Australia’s most populous state with 8.51 million residents, recording a 1.4% increase from the previous year.

Interstate Migration Trends

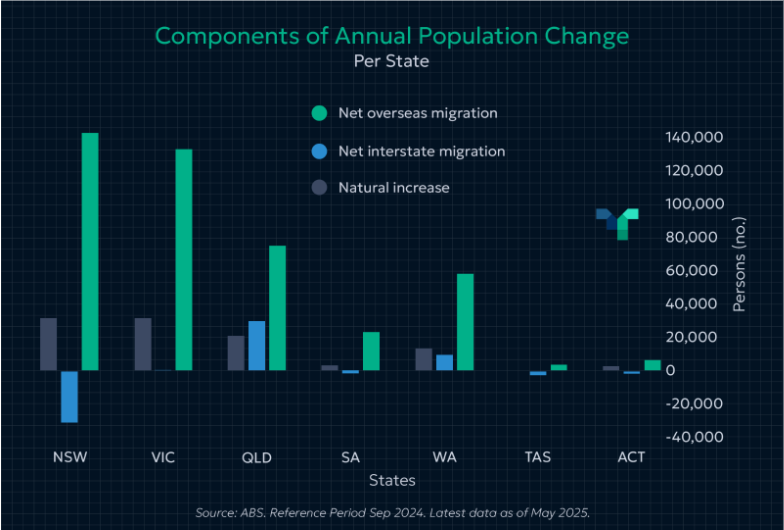

While overseas migration continues to be a major contributor to Australia’s population growth, interstate movement provides a no-less-valuable insights into housing demand from population change. Queensland and Western Australia are currently experiencing the highest net interstate migration inflows, whilst NSW has a significant negative net interstate migration.

Remote Work Impact on Housing Demand

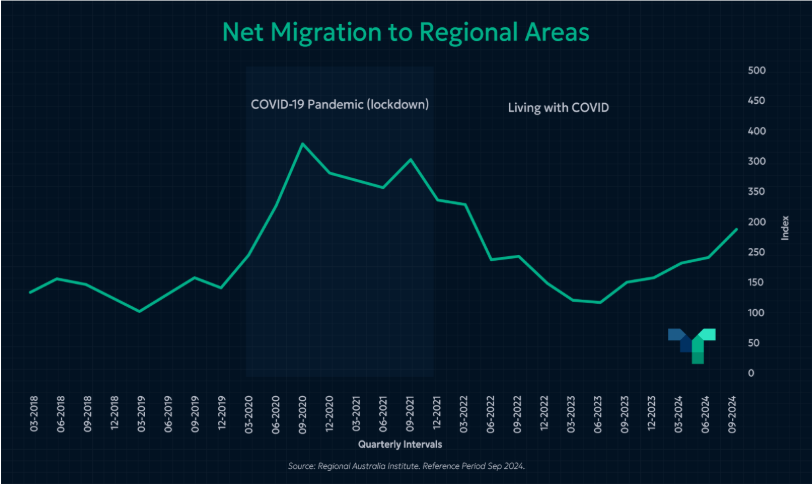

The rise of WFH, which started during the pandemic of 2020-2022, altered housing demand across Australia, and as of August 2024, approximately 36% of Australians work regularly from home. In more recent years, there has been another increasing trend for a population shift to regional markets from the capital cities, with net regional migration up 23.4% over the last 12 months – according to the latest data from the Regional Australia Institute.

This shift has created several market impacts:

- Demand for housing is rapidly outpacing supply in most regional markets across Australia

- Rents are also growing rapidly as rental housing demand is also outpacing rental housing supply

Demographic Shifts and Housing Preferences

Australia’s population is aging, with the median age projected to increase from 38.5 years in 2022 to 47.6 years by 2071. Simultaneously, Millennials and Generation Z are entering the property market with distinct preferences, typically seeking properties closer to urban centres with convenient access to amenities that are more abundant in inner city areas.

Growth Projections

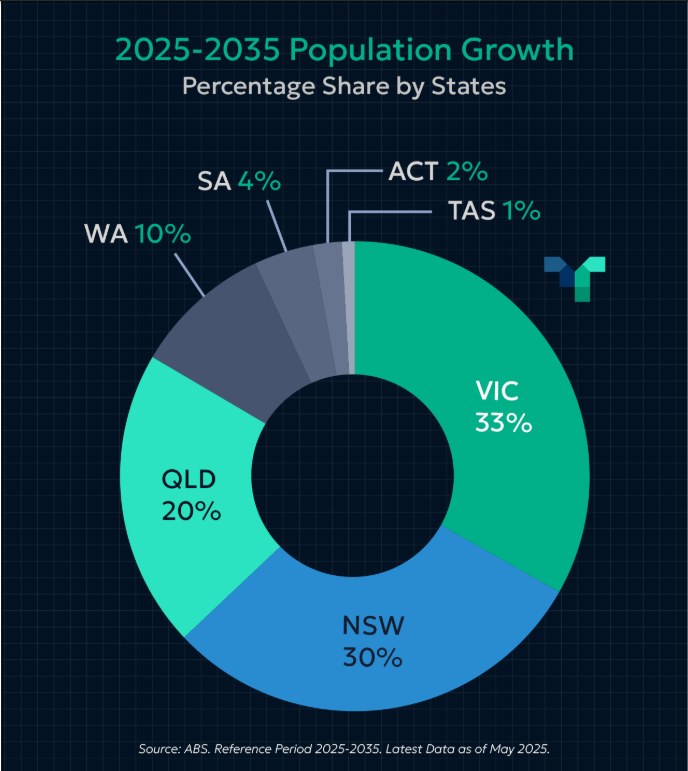

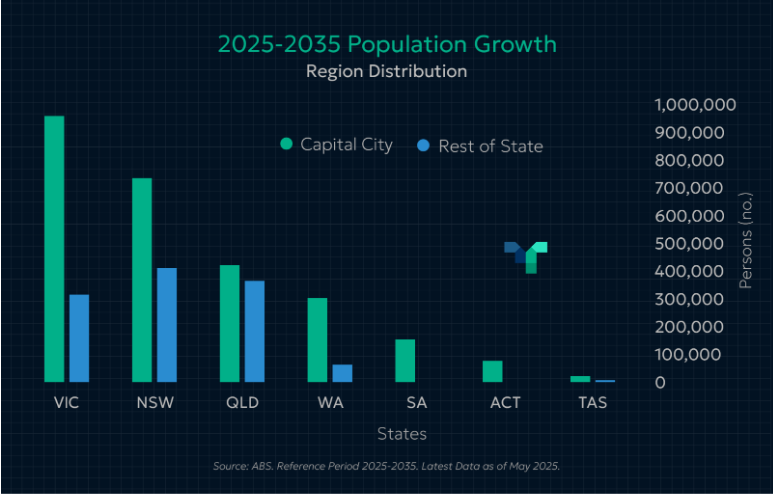

Population forecasts indicate Australia will reach 31 million residents by 2035, with Victoria, New South Wales, and Queensland absorbing approximately 83% of this growth.

Key trends to watch:

- Victoria and Melbourne exceeding growth rates of Sydney and NSW

- Continued strong growth expected for Melbourne, Sydney, Brisbane and Perth

- Metropolitan housing markets likely to remain under significant demand pressure

Summary:

- Population growth is a fundamental driver of property demand across all markets, but watch net interstate migration – not just total population growth.

- WA and QLD are currently benefiting from stronger migration inflows. NSW has high net overseas migration but significant negative net interstate migration.

- Regional locations are seeing an increasing trend in migration inflow from the capital cities in recent years.