Homeownership remains a cornerstone dream for many Australians, but with property prices climbing across major cities, understanding the income needed to purchase a median-priced home has become critical. Let’s break down exactly what it takes to enter today’s property market.

Current Property Market Snapshot

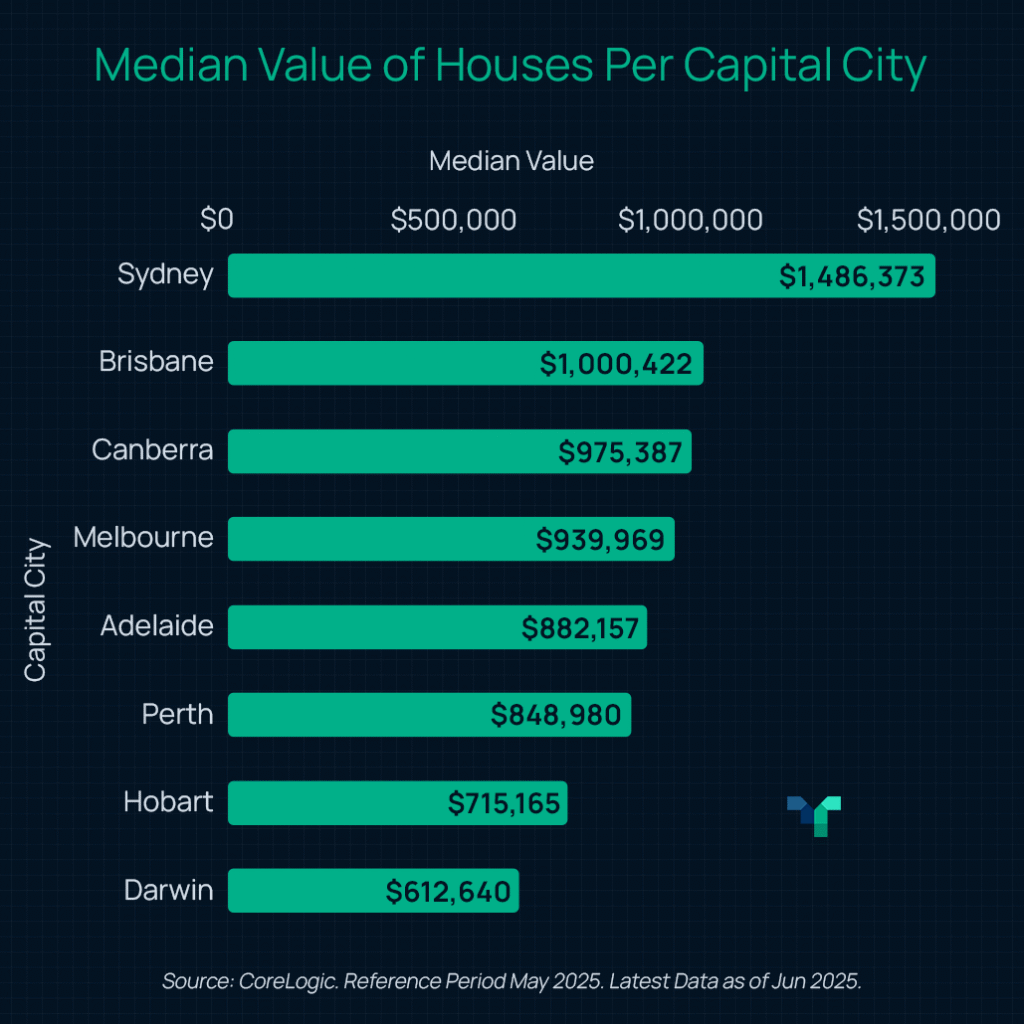

As of June 2025, the Australian property market continues to show significant regional variations. CoreLogic data reveals the combined median house value for all capital cities now stands at $1,025,742.

However, there are substantial differences between cities. Sydney stands out with a significantly higher median house value at $1,486,373, making it the most expensive city for home buyers by a considerable margin. This figure is nearly 50% higher than the next city on the list, highlighting Sydney’s ongoing status as the priciest housing market in the country.

Brisbane is the only other city with a median value surpassing the million-dollar mark ($1,000,422), reflecting its growing property market and increasing demand. Canberra follows closely behind at $975,387, while Melbourne also remains a high-value market at $939,969. These figures indicate that eastern capital cities, particularly those with larger populations and economic hubs, continue to command higher housing prices.

In contrast, cities such as Adelaide ($882,157) and Perth ($848,980) offer more affordable alternatives compared to their eastern counterparts, though their values are still substantial. Hobart and Darwin represent the lower end of the spectrum, with median house values of $715,165 and $612,640, respectively.

Assumptions Behind the Numbers

When calculating the income required for a median-priced house, the following parameters were used to reflect typical market conditions:

- Interest Rate: 6.14% (based on latest RBA data as of June 2025)

- Loan Term: Standard 30-year mortgage

- Deposit Size: 20% of property purchase price (avoiding Lenders Mortgage Insurance)

- Repayment-to-Income Ratio: Monthly mortgage payments not exceeding 30% of gross household income (the widely accepted “mortgage stress” threshold)

These assumptions provide a standardised framework, though individual circumstances may vary significantly.

Required Income per Region

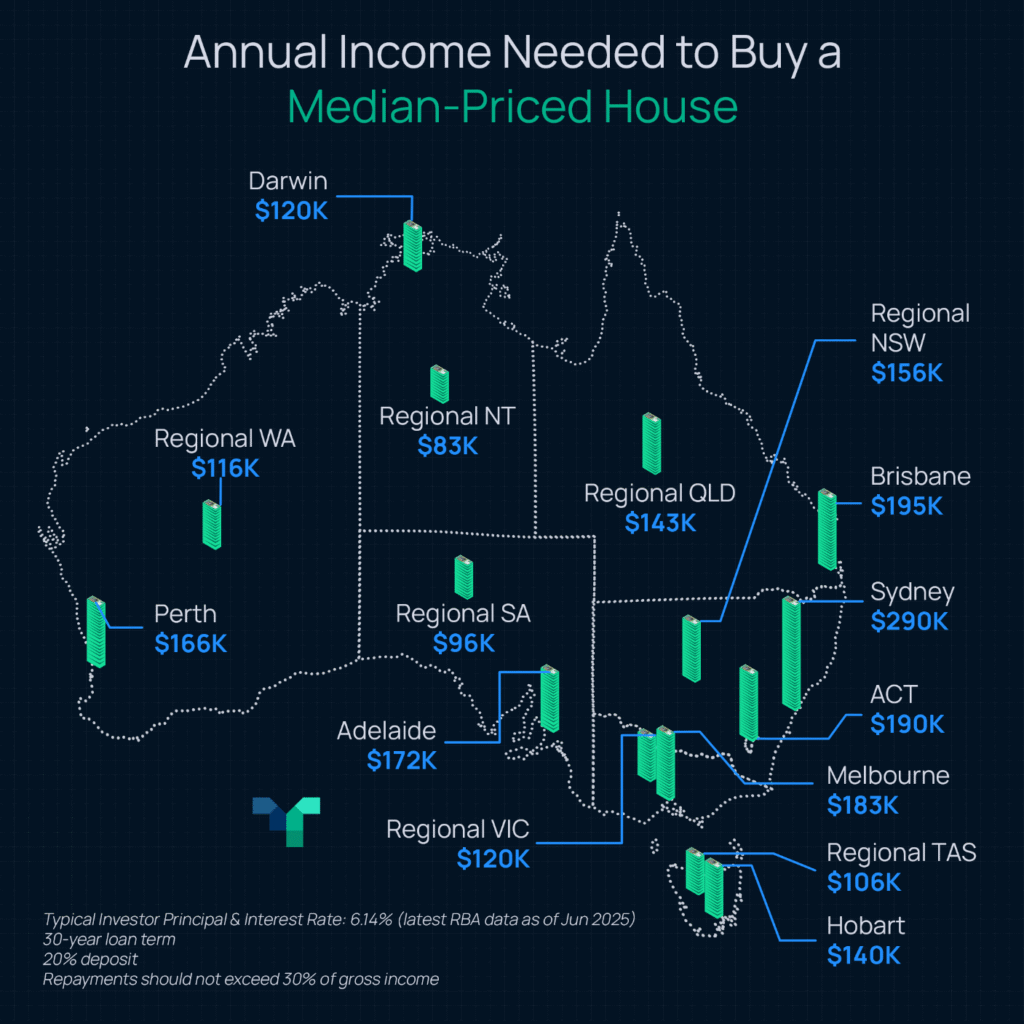

A stark divide exists between metropolitan and regional markets, with capital cities—especially Sydney—demanding substantially higher incomes.

Sydney stands as Australia’s least affordable market, requiring an annual income of $290,000 to purchase a median-priced house.

Other capital cities also demand high incomes, with Brisbane and Canberra requiring a household income of almost $200,000.

Regional areas generally present more accessible entry points. Regional NT ($83,000) and Regional SA ($96,000) rank among the most affordable markets.

Some regional areas, particularly in New South Wales ($156,000) and Queensland ($143,000), still require incomes well above the national average, highlighting persistent affordability challenges beyond the capitals.

Other Factors Affecting Affordability

- Down Payment: The size of your down payment significantly affects affordability. A larger down payment

- Reduces the loan amount

- Eliminates the need for private mortgage insurance

- Lowers monthly payments

- Interest Rates: Current rates plus APRA’s mandatory 3% buffer significantly impact borrowing capacity

- Additional Costs: Property taxes, homeowners insurance, and potential HOA fees must be factored into affordability calculations

- Location Variations: Significant price differences between cities offer opportunities for those willing to consider different locations

The path to homeownership in Australia requires careful consideration of income requirements, which vary significantly across different capital cities. While Sydney demands the highest household income annually for a median-priced home, other capital cities offer more accessible entry points for prospective homebuyers. Understanding these income requirements is crucial for setting realistic expectations and making informed decisions about property purchases in today’s market.

Key Takeaways

- Sydney remains Australia’s least affordable housing market, requiring a household income of $290,000 to purchase a median-priced house ($1,486,373).

- Income requirements vary dramatically across capital cities: Brisbane ($195,000), Canberra ($190,000), Melbourne ($183,000), Adelaide ($172,000), Perth ($166,000), Hobart ($140,000), Darwin ($120,000).

- While regional areas generally present more accessible entry points, some regional areas, particularly in New South Wales ($156,000) and Queensland ($143,000), still require incomes well above the national average.

- A larger deposit significantly improves affordability by reducing loan amounts and monthly repayments, while avoiding Lenders Mortgage Insurance.